In response to the increase of the “Minimum Wage for Employees” to 7,280 patacas per month effective from 1 January 2026, the upper and lower limits of the contribution basis under the Joint Provident Fund Scheme, as well as the upper limit of the contribution amount under the Individual Provident Fund Scheme, will be automatically adjusted on the same date in accordance with the law.

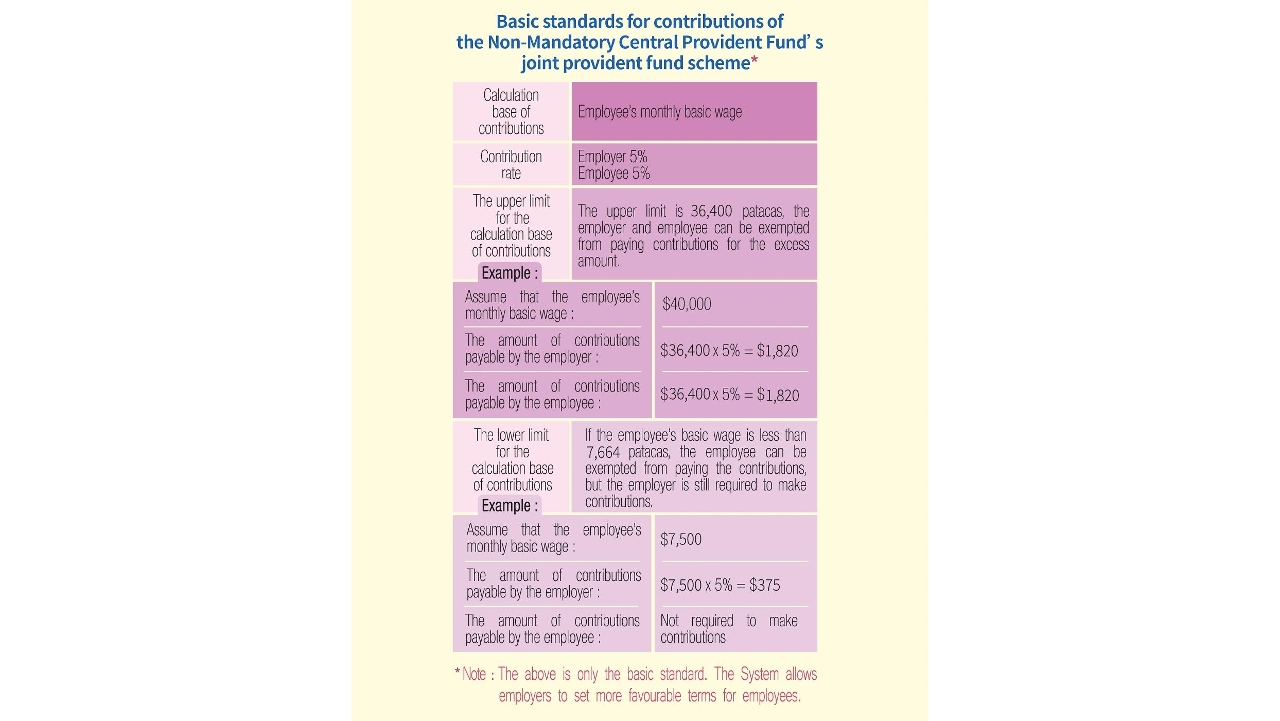

Under Law No. 7/2017, the Non-Mandatory Central Provident Fund System, the Joint Provident Fund Scheme takes the employee’s monthly basic wage as the basis for calculating contributions, with the contribution amount set at 5% of this calculation basis. If, after deducting the contribution, the employee’s actual basic wage for the month falls below the stipulated Minimum Wage, the employee shall be exempt from contributing, while the employer must still make contributions. If the employee’s actual basic wage for the month exceeds five times the Minimum Wage, neither the employer nor the employee is required to make contributions on the excess amount. Following the adjustment of the Minimum Wage, the lower limit of the contribution basis for the Joint Provident Fund Scheme will be raised to 7,664 patacas, while the upper limit will increase to 36,400 patacas.

Under the Individual Provident Fund Scheme, the maximum monthly contribution amount is set at 10% of five times the Minimum Wage, rounded down to the nearest multiples of hundred patacas. Accordingly, the upper limit of the contribution amount will be automatically adjusted to 3,600 patacas, while the lower limit of the contribution amount will remain at 500 patacas.

For enquiries, please call 2853 2850 during office hours or visit the Social Security Fund website at www.fss.gov.mo.